This post is also available in: Bahasa Malaysia Bahasa Indonesia

Accounting for inventory in MYOB

There are two inventory accounting methods, periodic and perpetual.

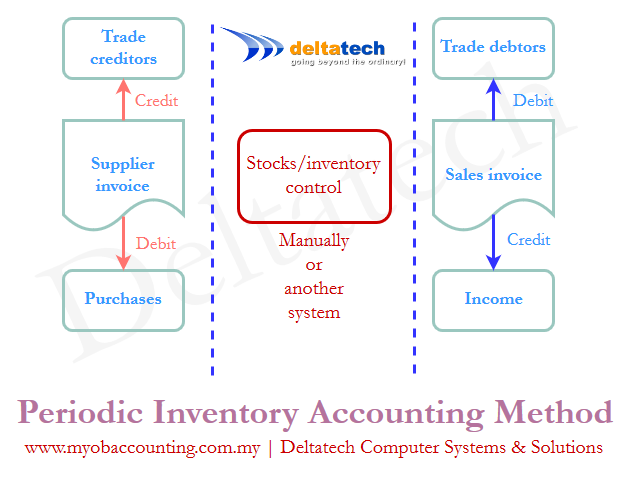

Periodic Inventory Accounting

In periodic inventory accounting, inventory balances are updated periodically. When goods are sold, only the Income account is updated.

A stock check is periodically performed, in most cases at the end of the financial year, to get the value of stocks on hand.

With this value, the cost of sales is calculated to arrive at gross profit as shown in the example below:

| Income | 557,000.00 | This is updated when you prepare a sales invoice.

Debit Trade Debtors |

|

| Less: Cost of sales | |||

| (a) Opening stock | 320,000.00 | This is the previous financial year’s closing stock brought forward to this year | |

| (b) Add: Purchases | 630,000.00 | This is updated when you purchase goods from your supplier

Debit Purchases |

|

| (c) Less: Closing stock | 490,000.00 | This amount is only known after a stock take is carried out. | |

| Cost of sales | (a) + (b) – (c) | 460,000.00 | Both the cost of sales and gross profit figures can only be arrived at after the closing stock value is known. |

| Gross profit | 97,000.00 | ||

As you can see from the above, whether the business is making a gross profit or loss can only be known once a stock check is performed.

There is a work around, and that is to assume the margin, which is 17% in the example above, and calculate what the gross margin should be.

So, if you needed to know what your gross margin is at any point in time without carrying out a stock check, you can take your gross sales and multiply it by 17% to arrive at an estimate.

More importantly, in a periodic inventory accounting system, you would need to track inventory movements separately.

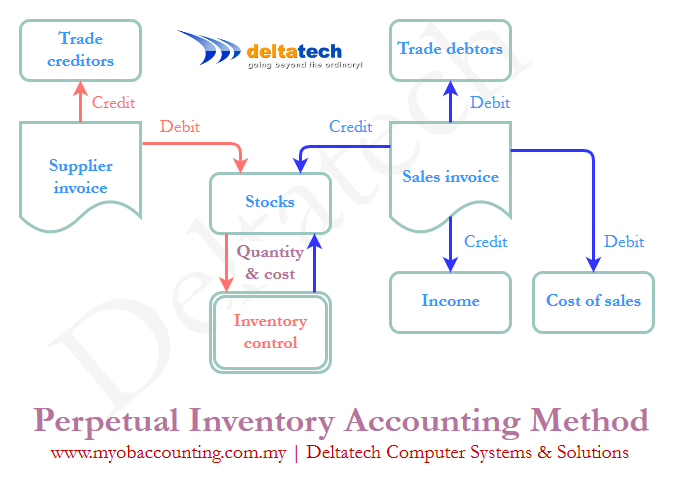

Perpetual Inventory Accounting

In a perpetual stock accounting system:

- When you record a purchase, the stock account is debited instead of the purchases account.

This increases your stock quantity and value. - When a sale is recorded, in addition to debiting trade debtors and crediting income, an additional entry is made as follows:

| Debit Trade Debtors | |

| Credit Income | |

| Debit Cost Of Sales | This entry reduces the quantity and value of stocks held as well as updates the cost of the sale. |

| Credit Inventory |

The advantage to this is:

- The cost of the sale is known immediately

- The margin on the sale is known

- The quantity of stock is updated, giving a better picture of what is on hand

The above advantages play a big role in helping management plan and budget.

A perpetual stock accounting system can provide up to date information on not just sales, but also cost of sales, gross margins and how much stock, both quantity and value, you have at any one time.

The movement of stock in perpetual inventory system is known immediately.

Although there are 2 additional accounting entries in a perpetual system, you do not actually need to make them. MYOB automatically makes those entries for you.

Stock takes would still have to be performed to verify the accuracy of the stock figures, especially at financial year end.

Your income statement using the perpetual inventory accounting method would look like this:

| Income | 557,000.00 | This is updated when you prepare a sales invoice.

Debit Trade Debtors |

| Cost of sales | 460,000.00 | This is updated when you issue a sales invoice.

Debit Cost of Sales |

| Gross profit | 97,000.00 |

Notice there are no Opening Stock, Purchases and Closing Stock accounts like the periodic inventory accounting method.

Inventory Accounting in MYOB

In MYOB, you can choose which method of inventory accounting you prefer, but do this when initially setting up MYOB, as this will affect the way you setup your inventory items and the chart of accounts.

Switching between the methods when you have already started using MYOB can be very tedious.

If you choose to use the periodic inventory accounting method, you will need to journalize the Opening Stock and Closing stock figures before you can arrive at the Gross Profit.

MYOB

MYOB Accounting & MYOB Premier

- Installing MYOB Accounting and MYOB Premier

- Upgrading MYOB Accounting and MYOB Premier

- Creating a new company file in MYOB

- Accounts

- Banking

- Sales

- Purchases

- Inventory

- Card file

- End of period processing in MYOB

- Data security/integrity